THE EARLY BIRD

IS THE ONE WHO PROFITS

Act on the latest news

and make your trades on ITS

while America is still asleep

WHAT ARE THE BENEFITS OF THE U.S. MARKET?

Analytical support

GLOBAL BRANDS IN YOUR PORTFOLIO

On ITS, you can invest in shares of the world’s largest companies – market leaders in their respective sectors. Diversify your portfolio across industries by purchasing shares of big tech firms, consumer giants and automotive manufacturers.

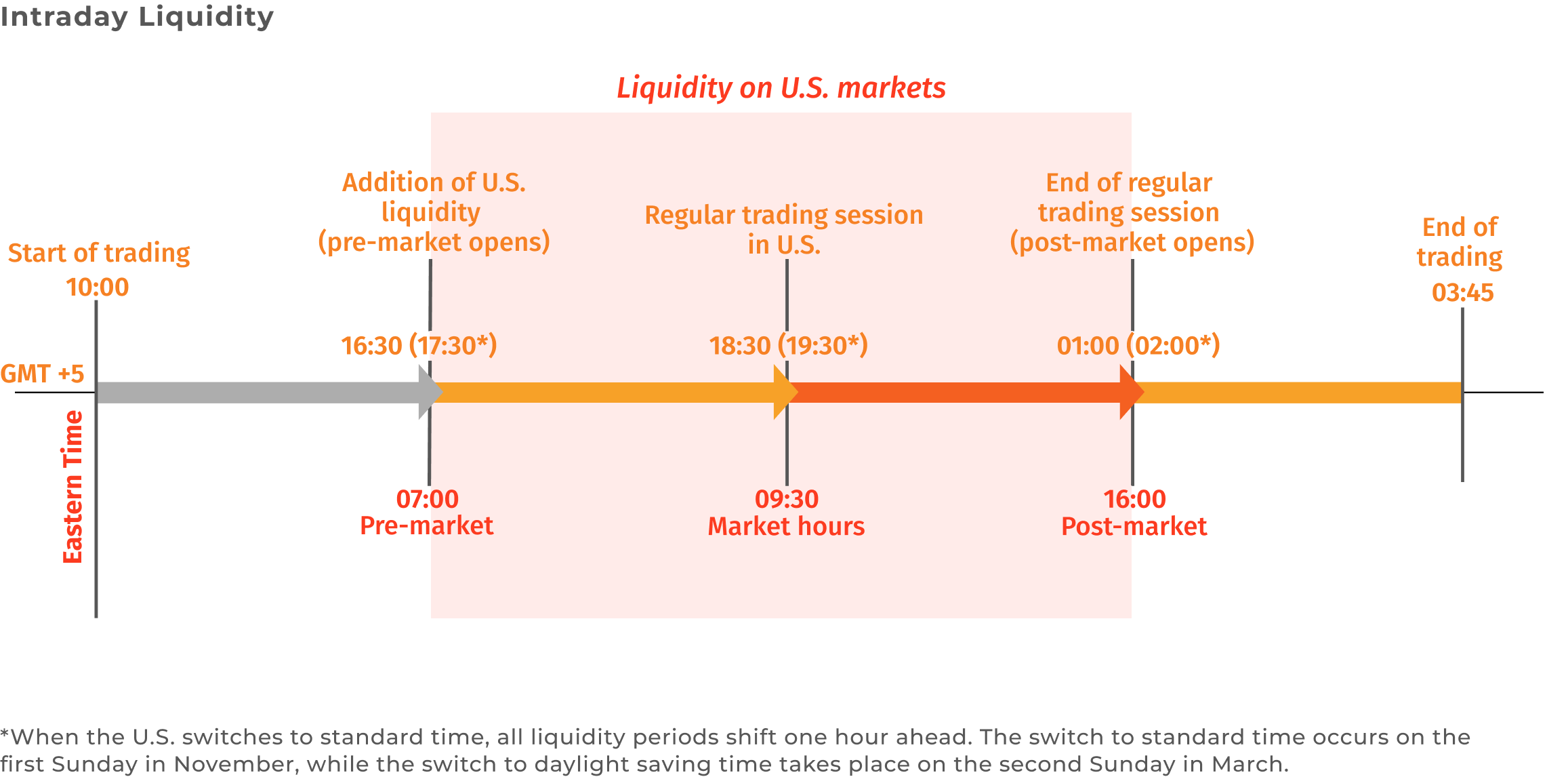

UNIQUE TRADING NICHE IN THE HONG KONG-LONDON TIME RANGE

GMT 0 — GMT +7

2.4 — 2.6 billion people

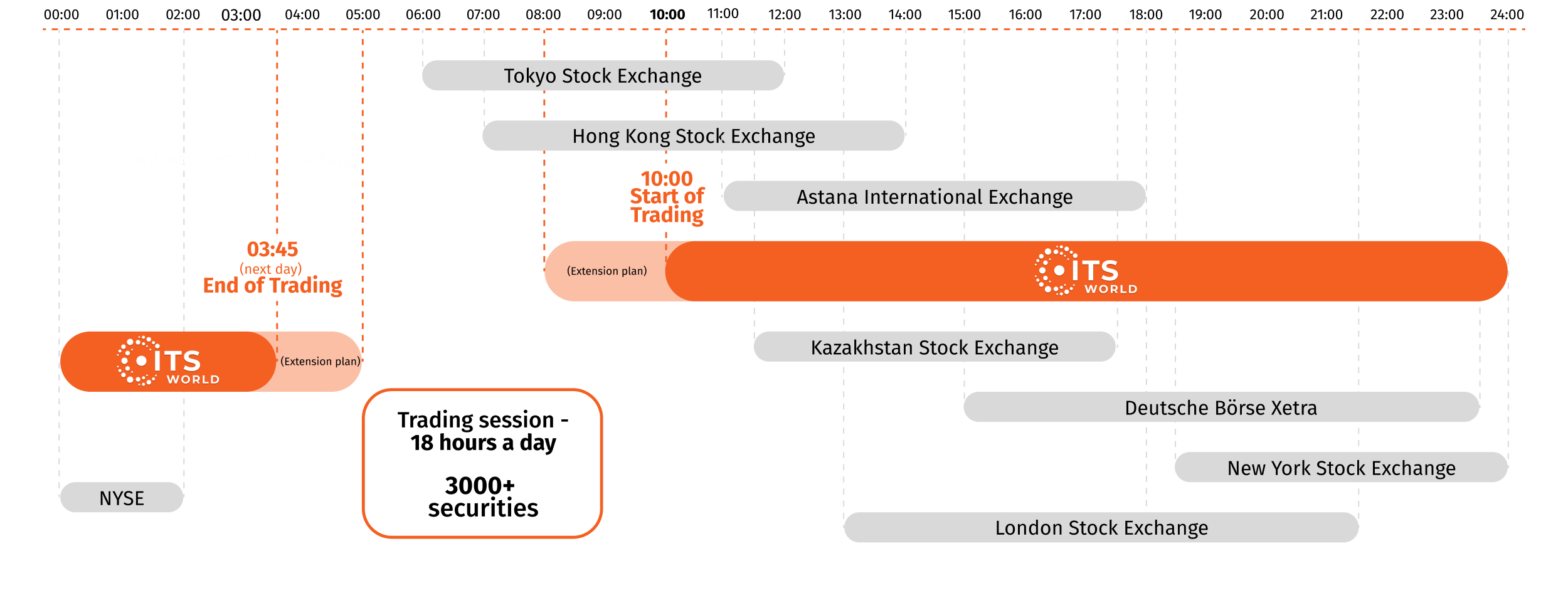

WHAT ARE THE BENEFITS OF AN EXPANDED 18HR TRADING SESSION?

01

First, it allows you to react to global events before traditional markets open. If there is important news in the U.S., Europe or Asia, you can immediately act on it for your trades, without waiting until the morning.

02

Second, in the morning on Astana time, you see the American closing prices and the post-market quotes on ITS. This means you have a unique opportunity to make a trade at closing prices while America is still sleeping. This is especially important when something significant happens to a country, the world, or the issuer.

03

Third, global movements can be tracked in the morning hours on Asian exchanges and European platforms (Tradegate, Xetra, the Frankfurt Stock Exchange, etc.).

04

If you like to analyze market data and look for opportunities for quick deals, then the expanded, 18-hour trading session is exactly what you need. This is a completely new level of financial opportunities for Kazakhstan.

The market has practically absolute liquidity, which enables any investment or speculative strategy to be implemented

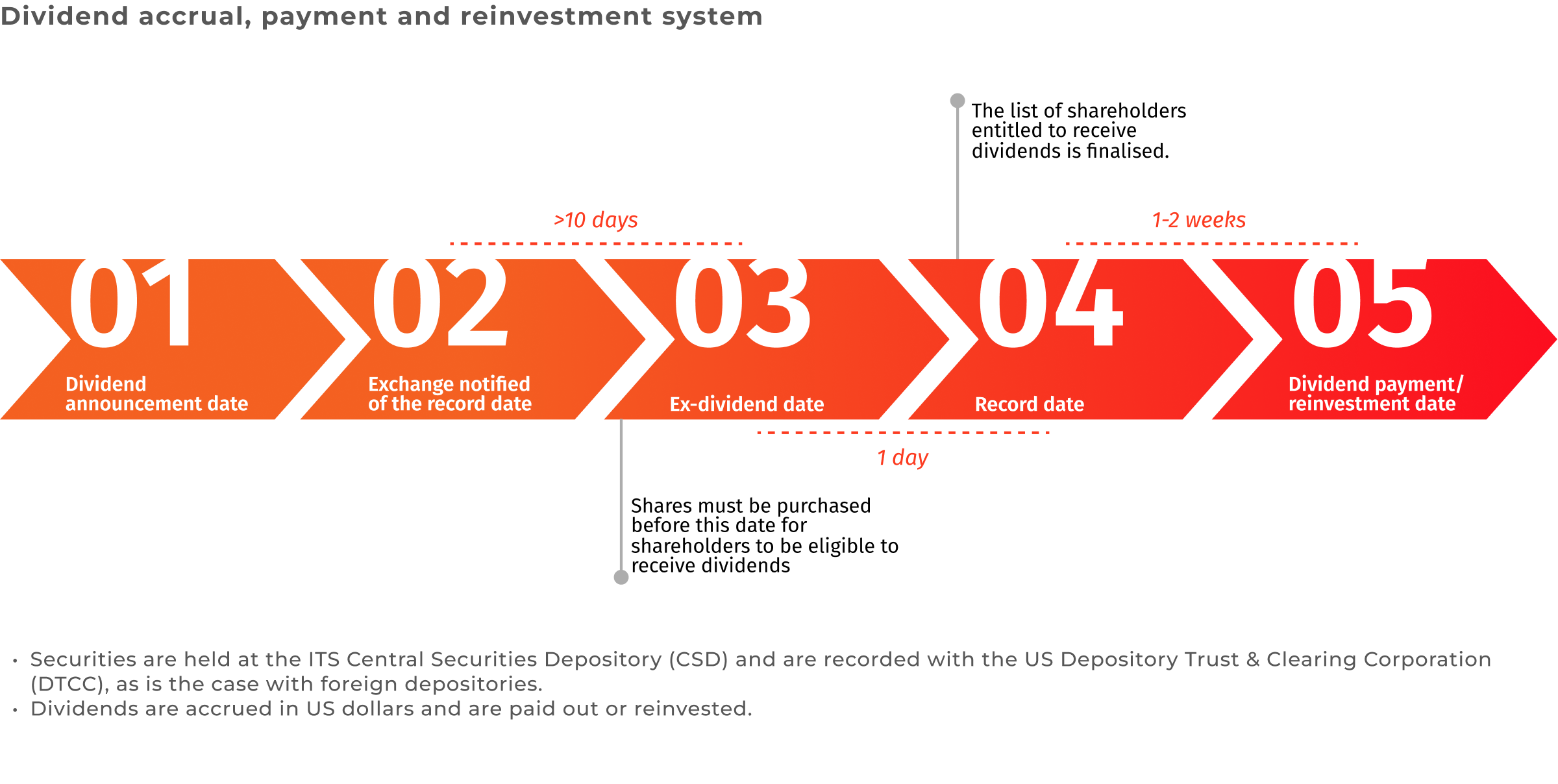

THERE ARE TRADING STRATEGIES BASED ON CORPORATE EVENTS SUCH AS EARNINGS RELEASES OR DIVIDEND PAYMENTS

Quarterly reports (10-Qs) are issued within 45 days of the end of each quarter.

Annual reports (10-Ks) are issued within 90 days of the end of the financial year.

- Jan. 10 to end-February

- April 10 to end-May

- July 10 to end-August

- Oct. 10 to end-November

- Increased volatility

- High speculative attractiveness

- Often there's a break in trends for particular stocks

- Future investment objectives are being set

- Sometimes the direction of the market's movement as a whole is determined, based on the results of the reporting season

- EPS (Earnings Per Share, the income for one share)

- Company revenue/net profit for the period

- Product sales in core segments

- Margin as an indicator of efficiency (income/revenue ratio)

- Company forecasts for the upcoming quarter or year

- Strategic plans, including capital expenditures

- Assessment of the economy and consumer demand

- Announced and actually implemented buyback programs

It is necessary to take into account not how much a certain indicator has risen or fallen, but how it relates to experts' expectations, future forecasts.

ITS Central Securities Depository Limited has received the status of a qualified intermediary with primary withholding responsibility (WQI) from the U.S. Internal Revenue Service.

The U.S. Internal Revenue Service strictly adheres to a principle of collecting taxes on payments from U.S. companies to foreign citizens. By default, it taxes income at a rate of 30%. But if a broker/depository has QI status, then it receives from the U.S. Treasury the right to independently calculate the tax amount for a specific investor (taking into account the costs of this investor, etc.), withhold it and transfer it to the U.S. Treasury. Not many companies have QI status.

You can get tax benefits for free. To do this, you need to request Form W-8BEN from your ITS partner broker and fill it out. The W8 is submitted by individuals who plan to receive income from dividends or coupon income on securities by American issuers using a preferential tax rate. Legal entities submit a slightly different form, W-8BEN-E.

INVEST IN THE U.S. MARKET

You can purchase U.S. market securities today from our partners, Paidax, Freedom Broker and N1BROKER. Check with your broker to find out when they will be connected to ITS.